Option Pricing and Portfolio Optimization: Modern Methods of Financial Mathematics (Graduate Studies in Mathematics) 送料無料 收藏

雅虎拍卖号:u1142777935

开始时间:11/27/2024 08:35:50

个 数:1

结束时间:12/04/2024 08:35:50

商品成色:二手

可否退货:不可

提前结束:可

日本邮费:卖家承担

自动延长:可

最高出价:

出价次数:0

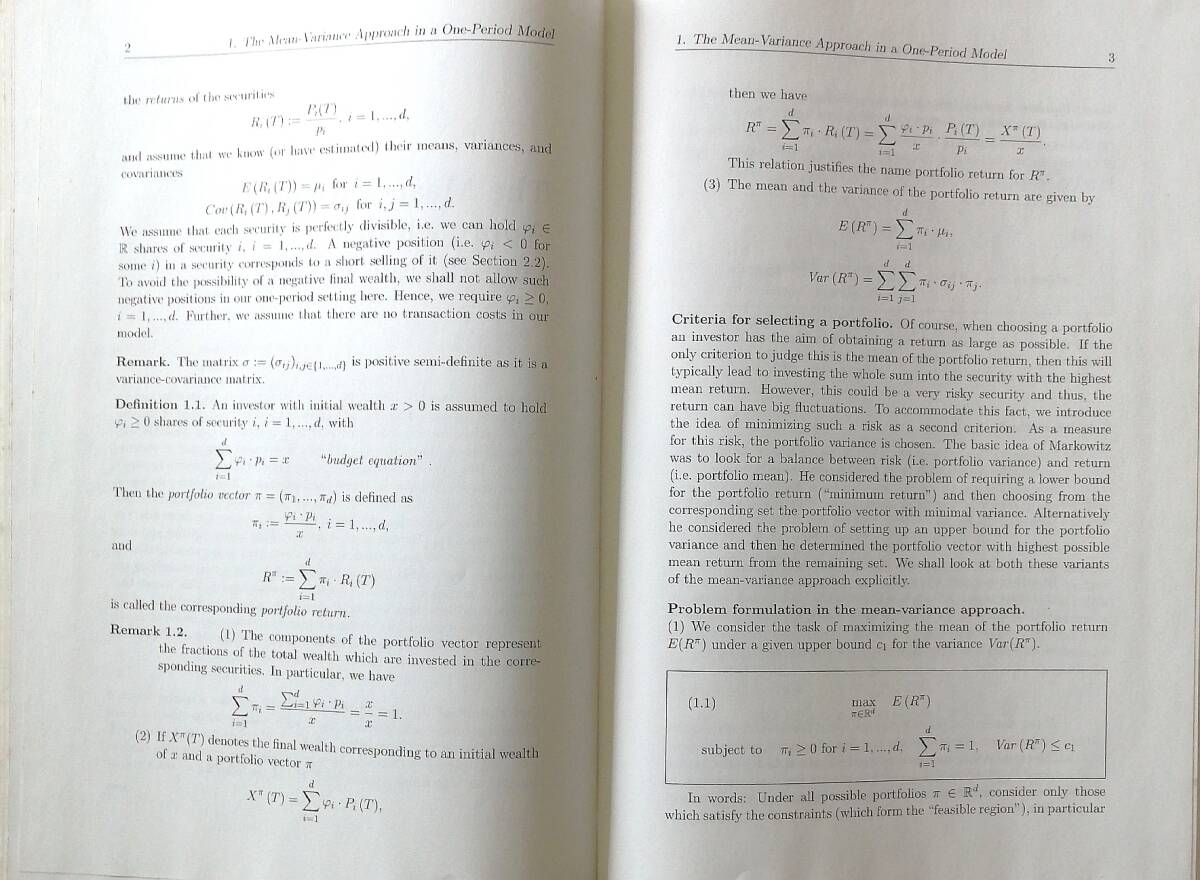

Option Pricing and Portfolio Optimization: Modern Methods of Financial Mathematics (Graduate Studies in Mathematics)

Option Pricing and Portfolio Optimization: Modern Methods of Financial Mathematics (Graduate Studies in Mathematics)| 出价者 | 信用 | 价格 | 时间 |

|---|

推荐